Indirect taxes

Specific (fixed amount) taxes and ad valorem (percentage) taxes and their impact on markets

Aim of imposing indirect taxes:

- To raise tax revenues → Government spending

- Internalize externalities → Achieve socially optimal level of output

Types of indirect tax:

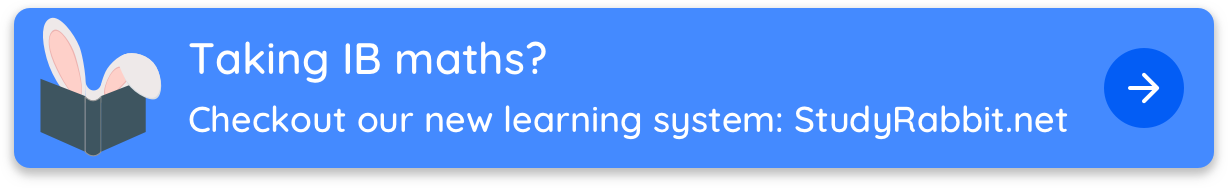

Specific tax: is where a fixed amount of tax is imposed upon a product.

- Shifts supply curve vertically upward by the amount of the tax

- i.e. A tax of $1 per unit → supply shifts $1 unit upward

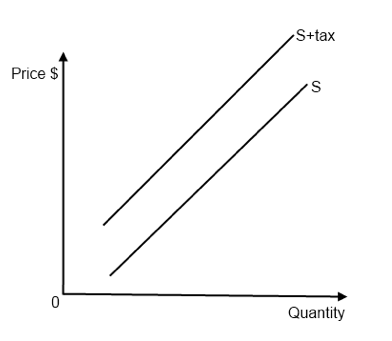

2. Ad valorem tax: is where the tax is a percentage of the selling price.

- Gap between S & S+tax gets bigger

- i.e. A percentage tax of 20%?at $5, tax $1; at $10, tax $2

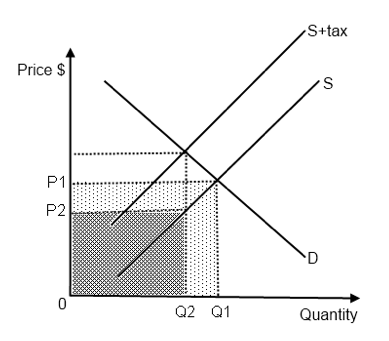

Figure 3.2 - The effect of ad valorem tax on the supply curve

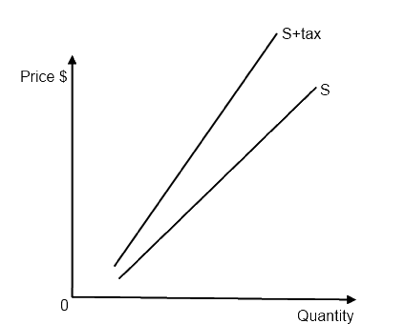

When either specific taxes or valorem taxes are imposed, the market will shrink in size (decrease in quantity), thus possibly lower the level of employment in the market, since firms might employ fewer people. (Curve shifts up because it increases costs of production.)

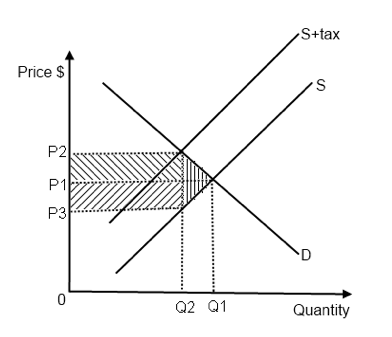

Figure 3.3 - Shift in supply curve due to indirect tax

Consequences of imposing an indirect tax:

- Producer: revenue falls (from P1xQ1 to P2xQ2)

- Consumer: price of the product rises (from P1 to P2)

- Government: receives tax revenue [(P2-P3)xQ2]

Figure 3.4 -The effect of an indirect tax

Tax incidence and price elasticity of demand and supply

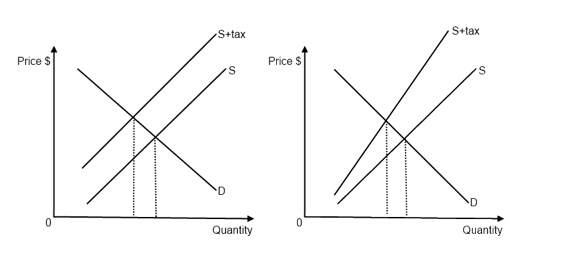

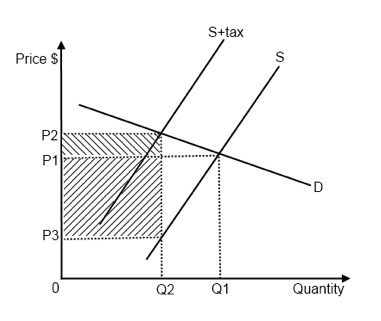

Figure 3.5 - Distribution of the tax burden

Forward diagonal lines: Tax burden on consumers

Backward diagonal lines: Tax burden on producers

Vertical lines: Deadweight loss (loss of consumer & producer surplus)

Tax incidence differs depending on the PED & PES of the product:

- Tax incidence on producer: (P1-P3)xQ2

- Tax incidence on consumer: (P2-P1)xQ2

- Price of the product: rises from P1 to P2

PED & PES (of a product)

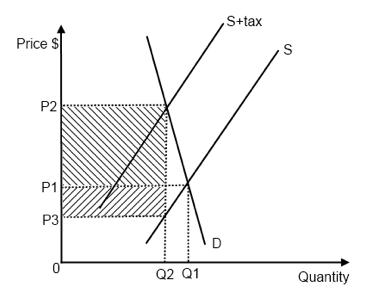

Figure 3.6 - Effect of an indirect tax on an elastic demand curve

- After the tax is imposed, the producer would like to raise the price up to P1 and pass on all the tax to consumers

- However, there is excess supply, and by market mechanism, price has to fall and a new equilibrium P2Q2 is formed

- At price P2, quantity Q2 is both demanded and supplied

P2-P1 Tax incidence on consumer

P1-P3 Tax incidence on producer

If a good with inelastic demand is taxed, the tax burden can be easily passed on to the consumer (PED is less than PES)

Figure 3.7 - Effect of an indirect tax on an inelastic demand curve

P2-P1 Tax incidence on consumer

P1-P3 Tax incidence on producer